Collection: Reverse charge procedure / does not apply to issuers from Germany

It is important that the recipient of the service be provided with a VAT ID. Please use the contact form for this purpose.

If you don't have a tax number, you must go to the rental shop in Germany .The VAT debtor is generally the business owner who carries out the transaction. In certain cases, however, the tax liability is shifted from the business owner carrying out the transaction to the service recipient. This is known as the " reverse charge procedure."

The scope of application of the reverse charge mechanism includes the provisions in § 13b UStG paragraph 1 and paragraph 2.

-

Needle felt carpeting including on-site installation

Regular price €14,95 EURRegular price -

Bar Stool Z Shape Simple

Regular price €45,00 EURRegular price -

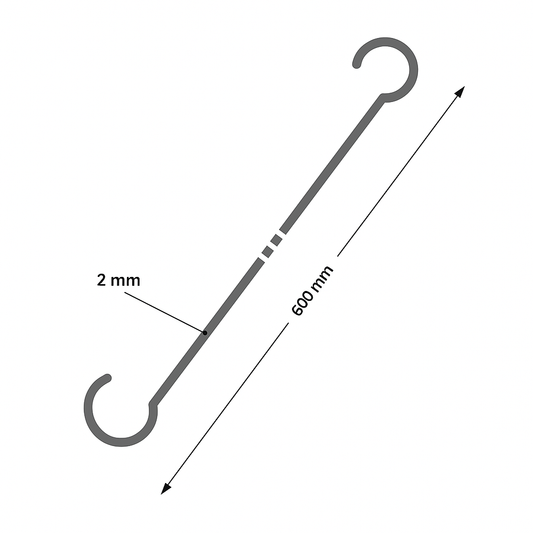

Double hook galvanized for hanging pictures and other items in 300 mm and 500 mm

Regular price €3,50 EURRegular price -

Table white in 120x 60 or 60x 60cm

Regular price From €59,00 EURRegular price -

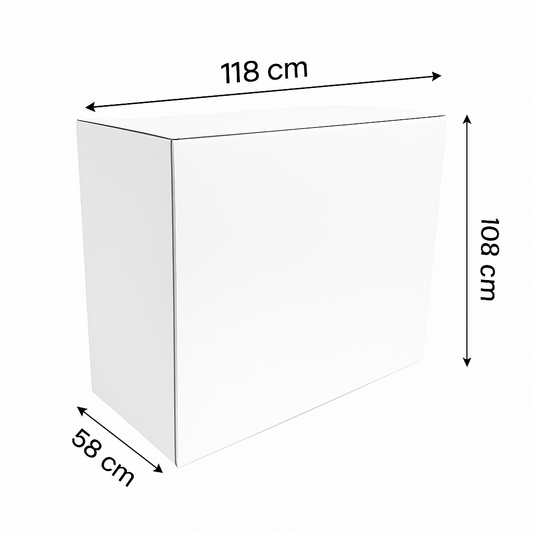

Information counter in white with central shelf, dimensions 118 x 108 x 58 cm

Regular price €119,00 EURRegular price -

Barhocker höhenverstellbar schwarz und weiss

Regular price €69,00 EURRegular price -

Curtain for changing room white with rod for 1000mm width

Regular price €35,00 EURRegular price -

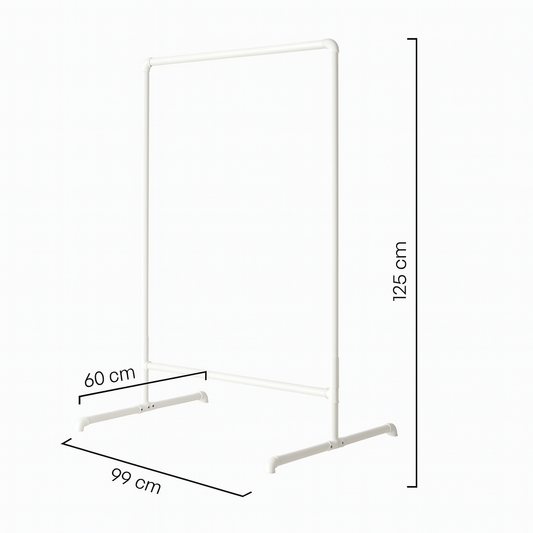

Freestanding clothes rack in white

Regular price €79,00 EURRegular price