Collection: Reverse charge procedure / does not apply to issuers from Germany

It is important that the recipient of the service be provided with a VAT ID. Please use the contact form for this purpose.

If you don't have a tax number, you must go to the rental shop in Germany .The VAT debtor is generally the business owner who carries out the transaction. In certain cases, however, the tax liability is shifted from the business owner carrying out the transaction to the service recipient. This is known as the " reverse charge procedure."

The scope of application of the reverse charge mechanism includes the provisions in § 13b UStG paragraph 1 and paragraph 2.

-

Color cards 631 for wall design

Regular price €25,00 EURRegular price -

Mauly clip in white for fastening fabrics and other

Regular price €3,95 EURRegular price -

Hook with nylon cord for hanging pictures and other items

Regular price €4,95 EURRegular price -

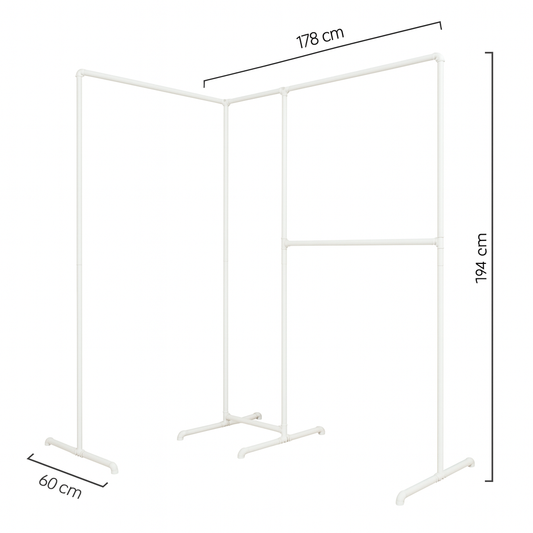

Clothes rack corner system in white

Regular price €159,00 EURRegular price -

Freestanding clothes rack with space-saving hanging space in white over two levels

Regular price €109,00 EURRegular price -

White height-adjustable bar table

Regular price €79,00 EURRegular price